Germany, as the largest economy in the Eurozone, has long been viewed as both a stabilizing force and a source of economic imbalance within the monetary union. With its export-driven economy, strict fiscal policies, and dominant influence over European financial mechanisms, Germany’s economic decisions have far-reaching consequences for the entire Eurozone. But is Germany truly the unshakable pillar of stability, or does its economic model create distortions that hinder the collective growth of the bloc? This article examines Germany’s role in the Eurozone from a multi-dimensional perspective, analyzing both its contributions and the challenges it presents.

The Backbone of the Eurozone Economy

Germany’s economic prowess is rooted in its highly competitive industrial sector, a massive trade surplus, and a commitment to fiscal discipline. The country is home to some of the world’s largest corporations, including Volkswagen, Siemens, and BASF, which drive European exports and employment. Its well-developed Mittelstand (small and medium-sized enterprises) further strengthens the economy, creating innovation and resilience.

As a major lender and guarantor in the European financial system, Germany plays a key role in ensuring monetary stability. The European Central Bank (ECB), though independent, often aligns with Germany’s preference for conservative monetary policies, emphasizing inflation control and financial stability over aggressive stimulus measures. Germany’s status as a net contributor to the EU budget and bailout funds underscores its financial dominance in the region.

The Problem of Economic Imbalances

Despite its economic strength, Germany’s rigid adherence to fiscal conservatism has created disparities within the Eurozone. Countries like Greece, Italy, and Spain have struggled with high debt levels and slower economic growth, in part due to Germany’s insistence on strict austerity measures. While Germany benefits from a weak euro—making its exports more competitive—its reluctance to embrace expansionary fiscal policies has been criticized for slowing down broader economic recovery efforts.

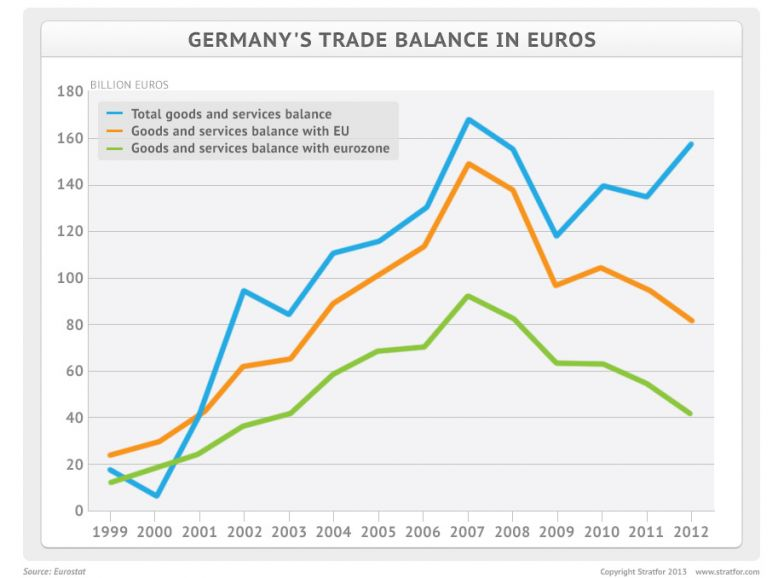

Another source of tension is Germany’s persistent trade surplus, which some argue contributes to imbalances within the Eurozone. The country’s large export surpluses come at the expense of weaker economies that rely on imports, exacerbating their trade deficits. Critics argue that a more balanced approach, with increased domestic investment and wage growth in Germany, could help stimulate demand across the Eurozone.

The Eurozone’s Structural Dilemma

One of the fundamental challenges of the Eurozone is the lack of fiscal and economic harmonization among its member states. Germany’s economic success is built on a model that may not be replicable for other countries due to structural differences in labor markets, productivity, and governance. Without mechanisms for wealth redistribution or a common fiscal policy, the disparities between Northern and Southern Europe are likely to persist.

Germany’s influence over Eurozone policies is often seen as a double-edged sword. While its financial discipline ensures stability, its reluctance to embrace deeper fiscal integration prevents the Eurozone from functioning as a truly unified economy. Calls for reforms, including Eurobonds and a stronger EU-wide fiscal policy, have faced resistance from Germany, which fears the moral hazard of subsidizing less fiscally disciplined nations.

Path Forward: Reform or Reinforcement?

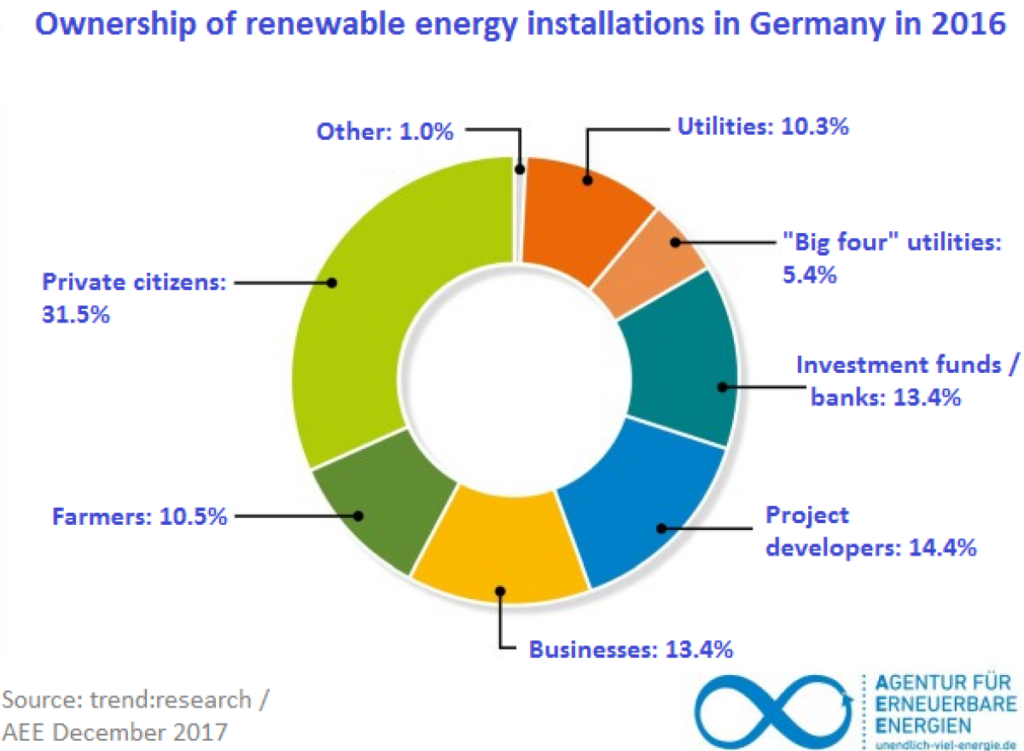

For the Eurozone to achieve sustainable growth, Germany must reconsider its economic approach. A shift toward higher public investment in infrastructure, education, and green energy could stimulate domestic demand and help balance economic growth across the region. Additionally, supporting greater fiscal coordination within the Eurozone—such as a centralized budget or debt-sharing mechanisms—could enhance resilience against future crises.

However, such changes require political will, both within Germany and across the Eurozone. As Europe faces ongoing challenges, including inflationary pressures, geopolitical risks, and technological transformation, Germany’s ability to adapt its economic policies will determine whether it remains a pillar of stability or a source of friction.

Conclusion

Germany’s role in the Eurozone is undeniably significant, but it is not without controversy. While its economic strength provides stability, its rigid policies contribute to regional imbalances. Moving forward, Germany must find a balance between financial prudence and greater economic solidarity. Only by embracing reform and cooperation can the Eurozone achieve long-term prosperity, ensuring that Germany remains an engine of growth rather than a roadblock to European unity.

Leave a Reply

You must be logged in to post a comment.