Germany, Europe’s largest economy, is known for its robust industrial base and strong corporate sector. However, its tax policies have long been a subject of debate. As global economic pressures mount, the German government is reassessing its corporate tax structure to strike a balance between maintaining fiscal stability and fostering a business-friendly environment. But how do these tax reforms impact businesses, and do they truly encourage investment?

Current Corporate Tax Landscape in Germany

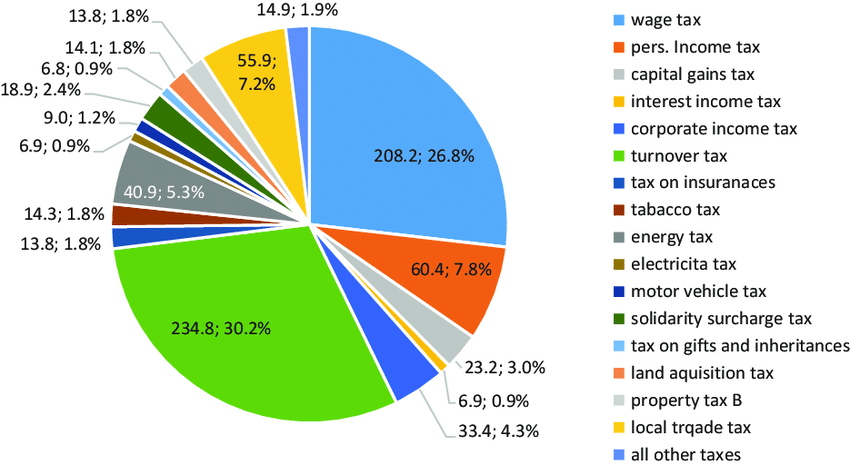

Germany has historically been known for its relatively high corporate tax rates compared to other EU and OECD countries. The combined corporate tax rate, including the federal corporate income tax (Körperschaftsteuer), the solidarity surcharge, and the municipal trade tax (Gewerbesteuer), can exceed 30%. This high tax burden has often been cited as a deterrent to foreign direct investment (FDI) and a challenge for domestic companies competing on a global scale.

Recent Tax Reforms and Policy Shifts

In response to economic headwinds, including inflation, supply chain disruptions, and global tax competition, the German government has been exploring tax relief measures to enhance business competitiveness. Recent reforms and proposed changes include:

- Reduction of Corporate Tax Burden: Policymakers have debated lowering the overall corporate tax rate to bring Germany in line with EU competitors such as Ireland (12.5%) and the Netherlands (25.8%).

- Incentives for Green Investments: The government has introduced tax credits and deductions for businesses investing in renewable energy, carbon reduction technologies, and sustainable manufacturing.

- R&D Tax Credits Expansion: To encourage innovation, Germany has expanded tax incentives for research and development (R&D), allowing businesses to offset a greater portion of their R&D expenses against taxable income.

- Small and Medium-Sized Enterprise (SME) Support: Given that SMEs form the backbone of the German economy, tax breaks and simplified compliance procedures have been implemented to reduce administrative burdens.

Impact on Businesses and Investment Climate

While these tax adjustments aim to stimulate investment, their effectiveness remains a subject of debate. Here’s how different sectors are reacting:

- Multinational Corporations (MNCs): Large corporations welcome the proposed tax cuts, as they enhance Germany’s attractiveness as a business hub. However, MNCs remain cautious due to the broader global trend of minimum corporate taxation under OECD’s BEPS initiative.

- Manufacturing and Export-Oriented Firms: Given Germany’s reliance on exports, tax incentives for industrial modernization and digital transformation are viewed favorably. Yet, concerns persist about rising energy costs and regulatory complexities overshadowing tax benefits.

- Startups and Tech Sector: Germany’s burgeoning startup ecosystem has long lobbied for more tax-friendly policies, particularly regarding employee stock options and venture capital taxation. Recent tax relaxations in this space are expected to boost innovation and entrepreneurship.

- SMEs: While tax relief measures aim to support SMEs, bureaucratic hurdles and local tax variations across municipalities still pose challenges for small businesses.

Challenges and Future Considerations

Despite positive developments, Germany’s tax system continues to face key challenges:

- Complexity and Compliance Costs: German tax regulations remain intricate, with high administrative costs for businesses.

- Regional Tax Disparities: The municipal trade tax varies significantly across different regions, creating an uneven playing field for businesses operating in multiple cities.

- International Tax Competition: Germany must balance domestic tax reforms with global tax coordination efforts, particularly within the EU and OECD frameworks.

Conclusion: A Double-Edged Sword?

Germany’s evolving tax policies reflect a strategic effort to enhance economic competitiveness while ensuring fiscal sustainability. While recent reforms signal a more business-friendly approach, the overall tax burden remains a concern. The effectiveness of these measures will ultimately depend on their execution, administrative simplification, and alignment with broader economic strategies.

For businesses operating in Germany, understanding and adapting to these tax changes is crucial. As policymakers continue refining the corporate tax framework, stakeholders must stay informed and proactive in leveraging new incentives for long-term growth.

Leave a Reply

You must be logged in to post a comment.